Fair pricing for your business

Finance your stock purchases, freight, marketing and more for up to four months – no fixed fees, no hidden costs, and no security taken.

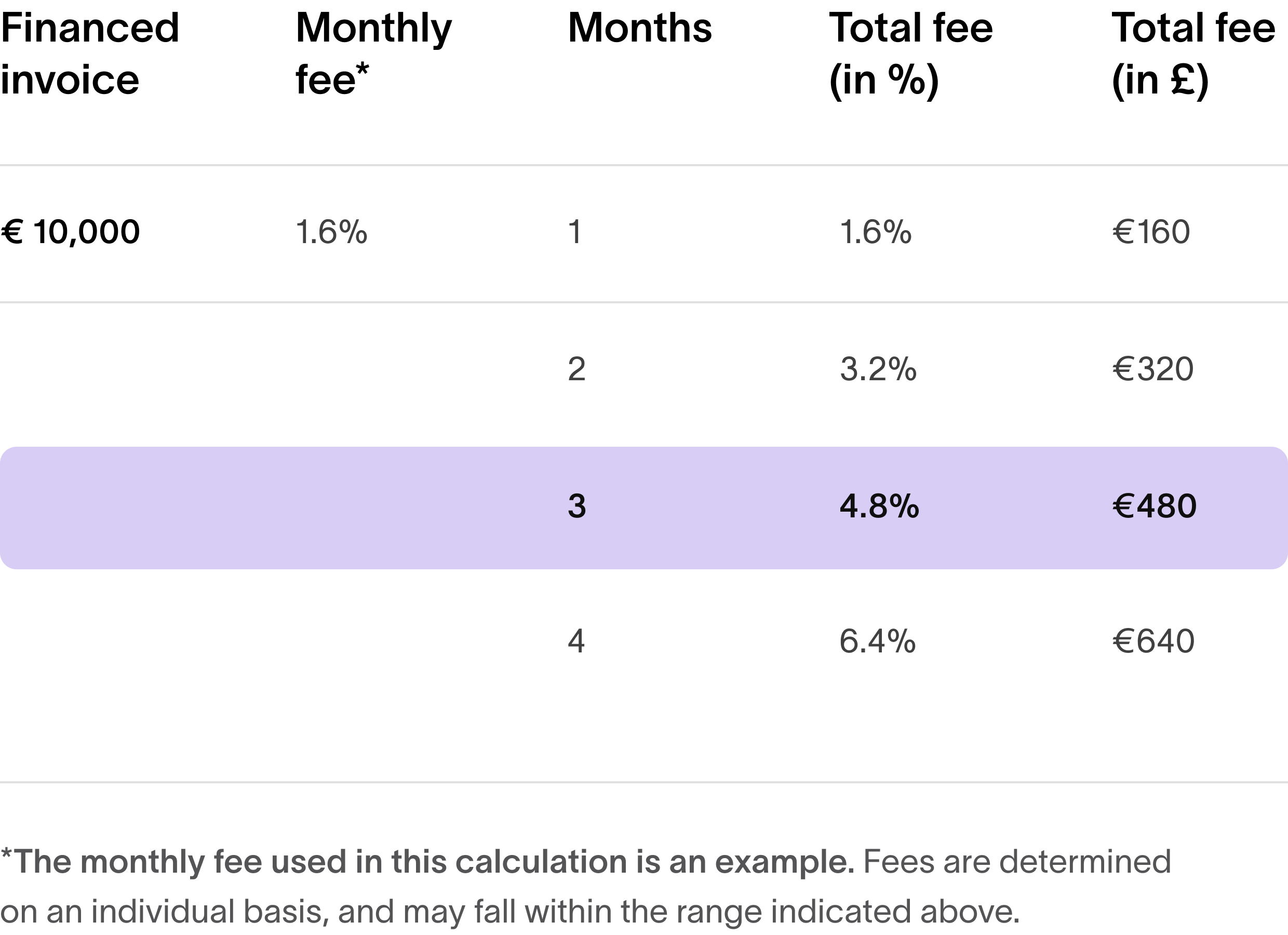

Treyd charges only a transparent flat fee for each financed invoice. That’s it. Signing up and having a limit available costs you nothing.

-

UK

-

SE

-

DK

-

NO

-

FI

-

IE

1,2 – 3%

/month

The exact fee varies depending on several factors, and is determined together with your limit application. Note that the initial fee given may fluctuate over time.

Benefits

The more you use, the less you pay

Your history with Treyd factors into the fee calculation. Build a healthy repayment history, and you’ll likely see your fee lower over time.

A limit that grows with your business

The limit given is based on your company’s financials. So as you grow your business, your Treyd limit will be adjusted accordingly.

Benefit by connecting your ERP system

Connecting your ERP system to Treyd will get you better and speedier limit assessments, as well as a discount on the monthly fee.

Company X received a limit of €50,000, with a monthly rate of 1,3%

They used Treyd to finance an invoice of €10,000 for 3 months.

The total fee will be €390.

What you see is what you pay

The total price for your repayment to Treyd will always be clearly shown before you confirm your order, so you don’t need to worry about any surprises.

A revolving limit

The Treyd limit is a continuous credit line that recharges as you pay back, and can be used as needed.

The Treyd limit is a non-committed line, and will be reassessed periodically.

The Treyd limit is a continuous credit line that recharges as you pay back, and can be used as needed.

Using the example of a €50,000 limit – if used continuously, this would let you finance yearly purchases between €150,000 and €600,000 (depending on your chosen repayment terms).

The Treyd limit is a non-committed line, and will be reassessed periodically.

Get an estimate

For a closer estimate of the pricing we can offer you, please get in touch with our team with more information about your business.

Note that we can only determine the exact price after you submit

your financials for review.